So What, Who Cares (vol 1, issue 17) Why the Baby Boomers better hope their kids love them

Older adults have been terrible at saving money for retirement. That's been reported for several years now, with a hefty percentage (30-40%) estimating that they won't have the post-work financial resources to replace 75% of their working income. (The 75% is generally regarded as what you need to maintain your lifestyle in retirement.)

Add in the rising numbers of senior citizens carrying significant mortgage balances (37% now, compared to 21% in 1989) and significant credit card balances (a $6000 balance, up from $2100 in 1989). Good luck estimating the repayment plans: In 2011, the median income for people age 65 and older was $27,707 for males and $15,362 for females.

(The giant disparity between male income and female income can be credited to career-long, gender-based pay gaps, and it goes a long way toward explaining why 56% of retired women are economically disadvantaged compared to 30% of retired men. Incidentally: Senate Republicans just blocked a fair pay measure for the fourth time in two years.)

Some are carrying student loans into retirement -- either for their own education or their children's. Those loans can affect whether or not a senior citizen can receive Social Security or federal tax refunds.

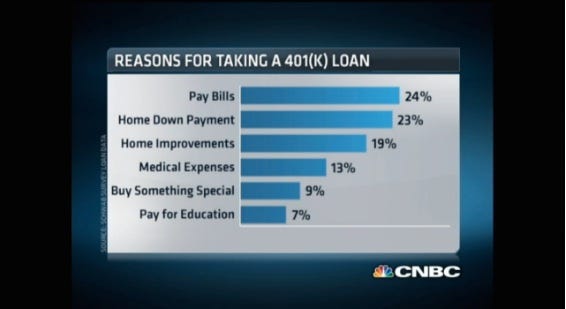

Today, a video clip at CNBC highlighted the bad news in the context of 401(k) loans: There's been a drop in 401(k) balances among households nearing retirement (age 59.5 and above) and one reason is a rise in 401(k) loans. I saved the chart (at right) and the top four reasons for drawing down the loans are striking: to pay bills, to handle housing costs and to pay medical bills. (Related: Wages have been flat for the last 13 years, even as housing and healthcare costs have risen.)

Then there are Charles Schwab's findings that 36% of baby boomers have less than $10,000 saved toward retirement, and 60% of baby boomers have less than $100,000 in retirement savings.

So what? Baby boomers are retiring at the worst possible time, i.e. at the end of a great recession that saw stagnant wages for over a decade and few gains in the stock market-funded retirement savings vehicles out there. A significant majority do not have enough money to last the rest of their lives.

Who cares? The government will, once all these broke seniors need expensive nursing care and geriatic medicine. (As will insurance companies.) The people related to all these broke seniors -- many of whom are already juggling their own student loan payments and rising child-care payments on their own flat wages -- are going to be losing sleep over this. And no doubt, some over-65s are beginning to think that holy cats, this is not going to get better.

*

Then there's the question of where to stash all these seniors once their houses get to be too much for them. Some folks have already identified the problems with our infrastructure -- it's built for young people -- but moving from a macro to a micro level: A lot of seniors are now facing the onerous task of cleaning out their houses and downsizing.

Getting rid of belongings can feel like losing a piece of personal history, and if one passes along an item imbued with that history to someone who fails to appreciate it, the rejection can sting. The task of tchotcke-tossing can be too much for retirees to tackle.

So what? This has actually created a new market opportunity for people who specialize in helping senior citizens downsize.

Who cares? Industries as diverse as eBay sellers, thrift stores, antique dealers and residential real estate are about to be faced with the challenge of dealing with all this stuff and all these big houses. Also, anyone who is looking to get into the personal organization industry could develop the specialty of post-retirement downsizing.

*

The baby boomers' stuff issue may not be transmitted to subsequent generations. Not because proud Gen Xers go out of their way to make their lives a refutation of their forebears' choices, but because decluttering and minimalism have become cultural movements significant enough to attract their own backlash.

So what? It's been a long time coming. Some folks, including yours truly, have been contending for ages that there's something oppressively showy and classist about the current iteration of minimalist living, which is its own brand of incredibly conspicuous consumption. It's also a cheap fix for larger problems. As Wil Wiles wrote:

Modernist determinism — the idea that our lives can be perfected by perfecting our environments — lives on in the rhetoric of a thousand marketing departments. It is backed by television’s pop psychology, where the mental health of hoarders is restored by de-cluttering. Doing something about our surroundings has become a surrogate for therapy.

Who cares? Anyone whose "Eyeroll Bingo" card includes the phrases "authentic," "artisanal," "curated life" or "simple abundance."

*

A final pop culture note: One of my favorite comic book writers is Mike Carey, and his series Lucifer is a funny, heartbreaking meditation on the struggle of one ex-angel to separate himself from his creator as permanently as possible. FOX has just ordered a pilot and it's possible Lucifer will make it to a network near you. One hopes they'll get past the piano bar early on and into the really great stuff, including making sweet Mona Doyle the goddess of hedgehogs, all of whom exploit her terribly.

*

Are you freaking over the possibility of tending your parents in their dotage, or have you been waiting for this moment -- and your chance to get your hands on their vintage Crazy Daisy dishware? Tell me via email or Twitter. Always let me know what you think about So What, Who Cares? If you really like it, tell a friend to subscribe.